Liqura LinqConnect

Build Smarter Insurance Workflows Without Reinventing the Stack.

LinqConnect is the agentic AI API layer that powers intelligent data enrichment, coverage recommendations, and dynamic risk classification—so your underwriters, platforms, and partners can move faster, smarter, and at scale.

Insurance is Drowning in Manual Work, Missing Data, and Lost Expertise.

- 40% of underwriters’ time is spent chasing data, not evaluating risk.

- 50% of commercial submissions are incomplete.

- Underwriting costs are rising, while experienced talent is retiring.

- Every missed question, misclassified business, and manual handoff slows time to quote—and costs trust.

You can’t build tomorrow’s insurance ecosystem on yesterday’s data process.

Built for Insurance Ecosystem Leaders

Whether you're a carrier, MGA, wholesale brokerage, platform, or insurtech—LinqConnect delivers plug-and-play intelligence through secure APIs.

Cut underwriting costs, speed up quote time, reduce loss ratios.

Wholesalers

Match submissions with appetite, fast. Streamline workflows, deliver more value upstream and down.

Insurtech Platforms & AMSs

Launch faster. Differentiate with embedded intelligence—without needing your own AI team.

Policy Admin + Submission Platforms

Power smarter workflows and out-of-box AI capabilities that drive sales.

🚀 What LinqConnect Unlocks for You:

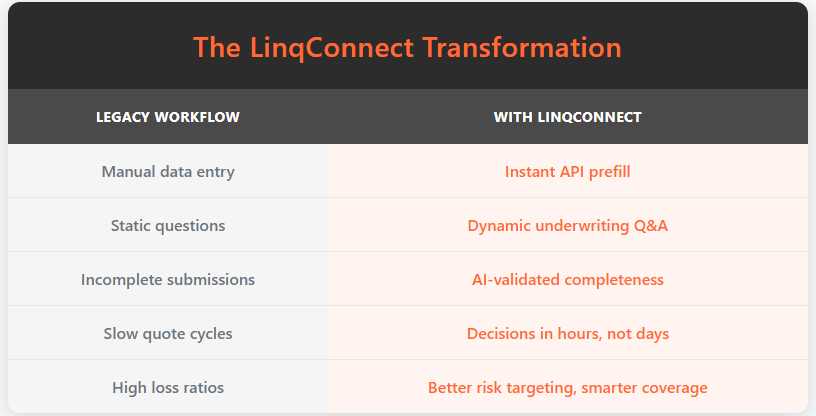

✅ 50% Faster Submissions

Auto-fill risk data, surface exposures, and cut quote time from 3 days to 1.

✅ 25% Fewer Errors

Minimize NIGO submissions and data gaps—at scale.

✅ Lower UW Costs by 30–50%

AI handles the heavy lifting. Your team focuses on decision-making.

✅ Improve Placement and Profitability

Get the right risks in the right markets—with fewer misquotes and misses.

✅ Future-Proof Your Platform

Embed intelligence without building it all from scratch.

How Insurance Leaders Are

Using LinqConnect Today:

🔧 Underwriting Enablement

→ Instantly pre-fill submissions, recommend questions, reduce back-and-forth.

📈 Coverage Optimization

→ Proactively suggest relevant coverage lines and add-ons at the point of quote.

📊 Risk Discovery

→ Surface exposures that human review alone often misses.

🔁 Submission Triage & Routing (Coming Soon)

→ Auto-prioritize submissions and direct to the right desk based on risk profile.

📂 Renewal Intelligence (Roadmap)

→ Detect operational changes, new exposures, and upsell moments—automatically.

Backed by Real Results:

📈 Up to 40% improvement in quote speed

🔒 SOC-compliant, secure data APIs

💬 Explainable AI: every recommendation, documented

“LinqConnect is helping us build what every carrier wants: the fastest, smartest quote pipeline in the market.”

— Digital Innovation Director, Mid-Market Carrier

Ready to Power Smarter Decisions at Scale?

You don't need more tools.

You need better intelligence in the ones you already use.